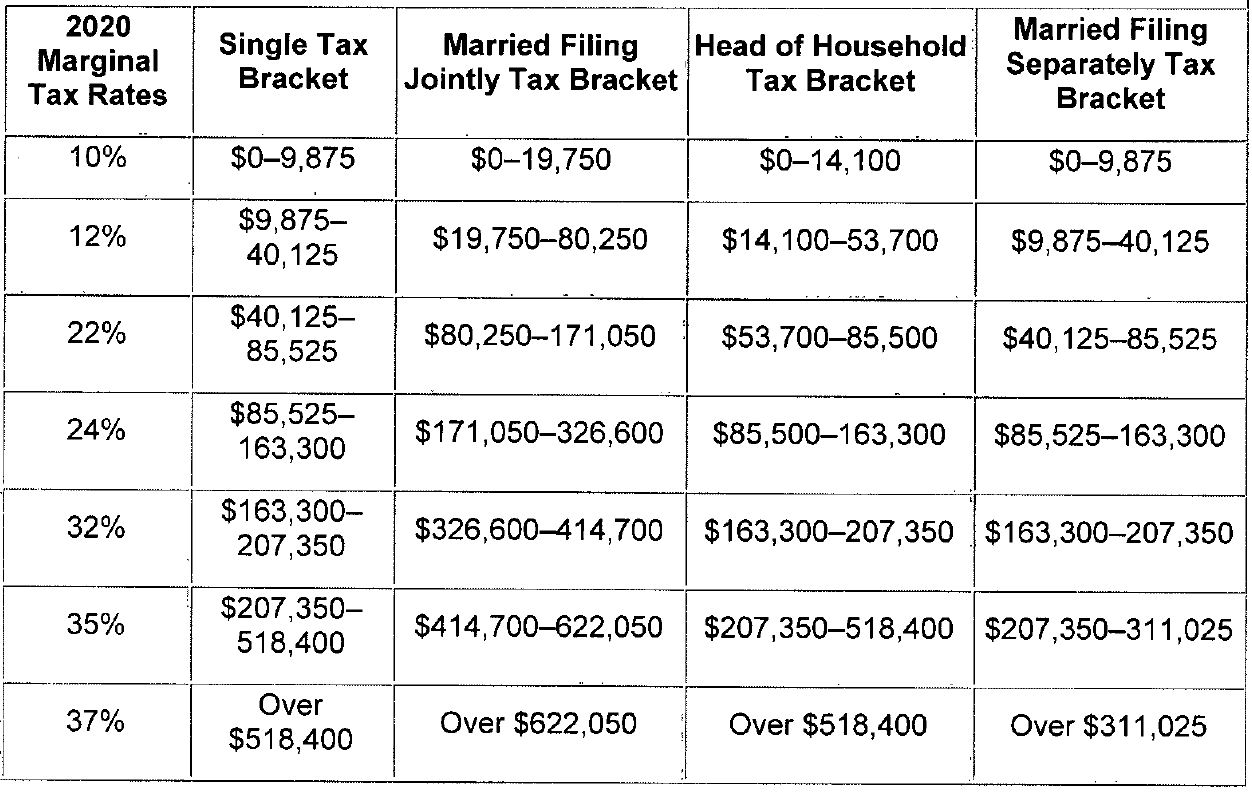

That is $6,600 less than if a flat 24% federal tax rate applied to your entire $100,000 of income. You can see that the estimated total federal tax on your $100,000 of taxable income given marginal tax rates would be about $17,400. That leaves $4,627 of your taxable income (the amount over $95,373) that is taxed at the 24% rate for your federal tax bracket.The next $50,649 of your income (from $44,726 to $95,375) is taxed at the 22% federal tax rate.The next $33,724 of your income (i.e., the amount from $11,001 to $44,725, which will make sense when you see the tax brackets below) is taxed at the 12% federal rate.The first $11,000 of your income is taxed at the 10% rate.

Here’s how the marginal tax rate works with this example:

The rest of your income is taxed at the federal income rates below 24%, i.e., 10%, 12%, and 22%. Instead, your $100,000 will be taxed at a marginal tax rate so that only some of your income is taxed at the maximum rate for your income that year (24%). You might think that since $100,000 falls into the 24% federal bracket, your tax would be a flat $24,000. Suppose your filing status is single, and you have $100,000 taxable income in 2023. How income tax brackets work with marginal tax rate examples

0 kommentar(er)

0 kommentar(er)